How Much Withholding Should I Claim On W4 2024. An employee can request an additional. Federal withholding tables determine how much money employers should withhold from employee wages for federal income tax (fit).

And is expected to last all day. That should result in the most accurate withholding.

Answering These Questions Is Easier Than You.

Tax withholding allows you to pay your federal, state and local taxes without taking up too much of your time.

A Federal Withholding Tax Table Is Usually In The Form Of A Table Or Chart To Simplify This Process For Employers.

If you are a single tax filer and your combined income is between $25,000 and $34,000, the ssa says you may have to pay income tax on up to 50% of your benefits.;.

An Employee Can Request An Additional.

The threshold amount for the tax year, as of january 2023, via the latest revision of irs publication 501 puts the threshold at $4,400 or more.

Images References :

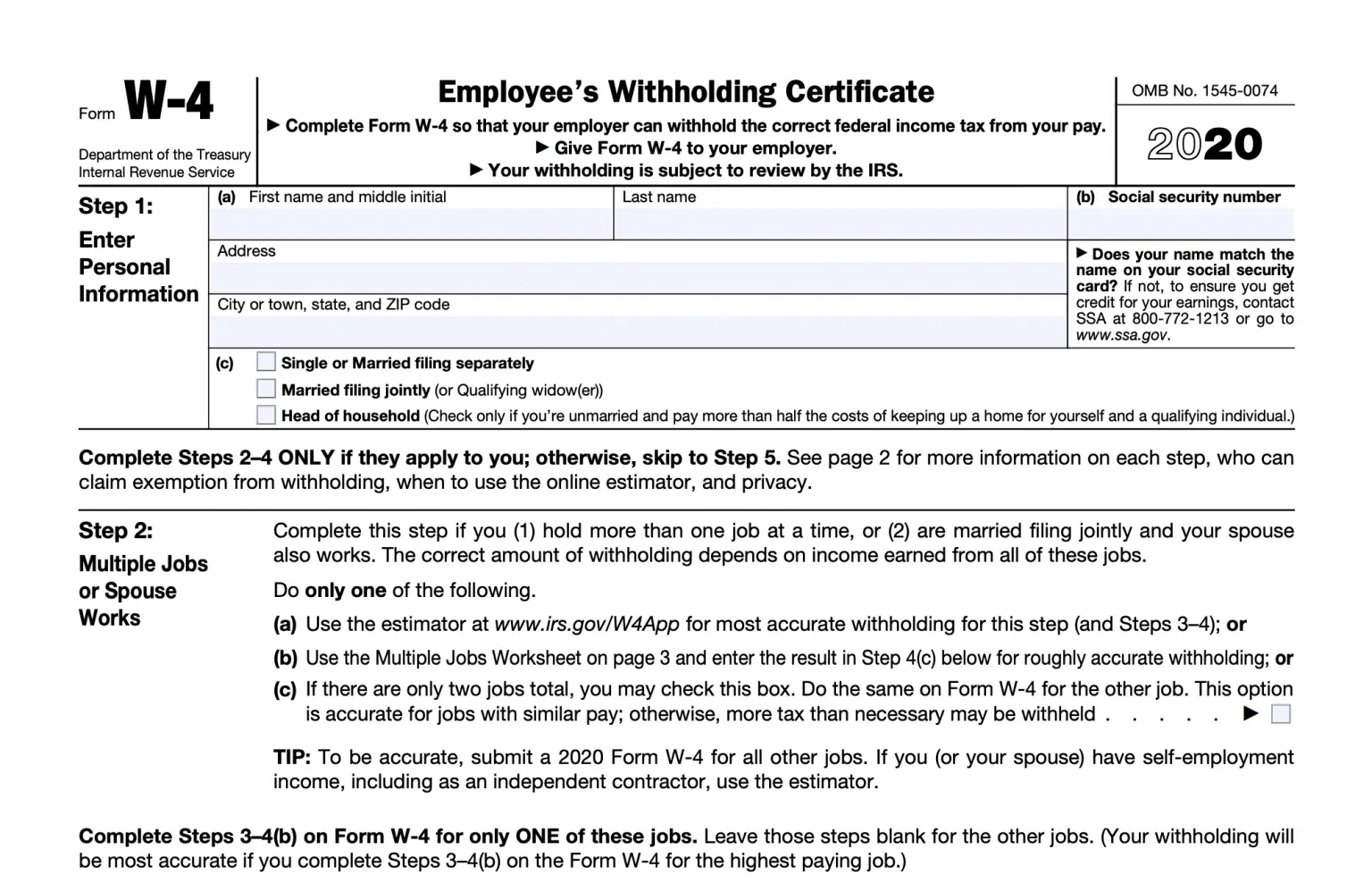

Source: avocadoughtoast.com

Source: avocadoughtoast.com

Should I Claim 1 or 0 on my W4 Tax Allowances Expert's Answer!, Pass the irs’s “support test,”. If too little is withheld, you will generally owe tax when you file your tax return.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. If too much is withheld, you will generally be due a refund.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, And when should you withhold an additional amount from each paycheck? You no longer need to calculate how many allowances to claim to increase or.

Source: www.pinterest.com

Source: www.pinterest.com

W4 Guide to the 2024 Tax Withholding Form NerdWallet W4 tax form, Each allowance claimed reduces the amount withheld. Keep more of your money in 2024.

Source: fity.club

Source: fity.club

Figuring Out Your Form W4 How Many Allowances Should You, That should result in the most accurate withholding. Keep more of your money in 2024.

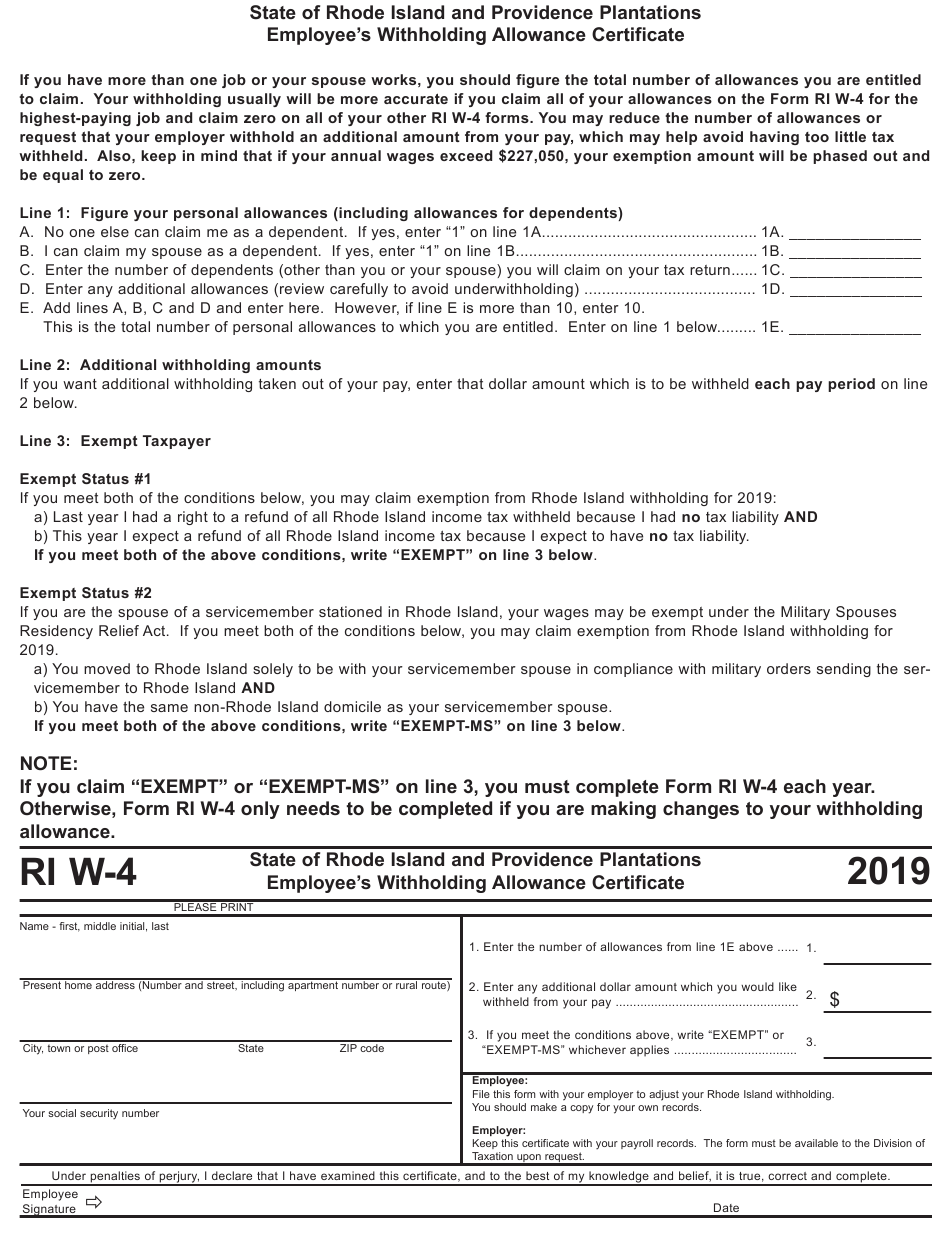

Source: oforms.onlyoffice.com

Source: oforms.onlyoffice.com

Form W4 (Employee's Withholding Certificate) template, Pass the irs’s “support test,”. Trump to attend florida classified documents hearing seeking dismissal of charges.

Source: w4formsprintable.com

Source: w4formsprintable.com

W 4 Employee's Withholding Allowance Certificate 2021 2022 W4 Form, Tax withholding allows you to pay your federal, state and local taxes without taking up too much of your time. You no longer need to calculate how many allowances to claim to increase or.

Source: www.signnow.com

Source: www.signnow.com

W4 20232024 Form Fill Out and Sign Printable PDF Template signNow, An employee can request an additional. So how much should you withhold in taxes?

Source: newyorktaxfactory.com

Source: newyorktaxfactory.com

What Is a W4 Form? How to Fill Out an Employee’s Withholding, And when should you withhold an additional amount from each paycheck? Answering these questions is easier than you.

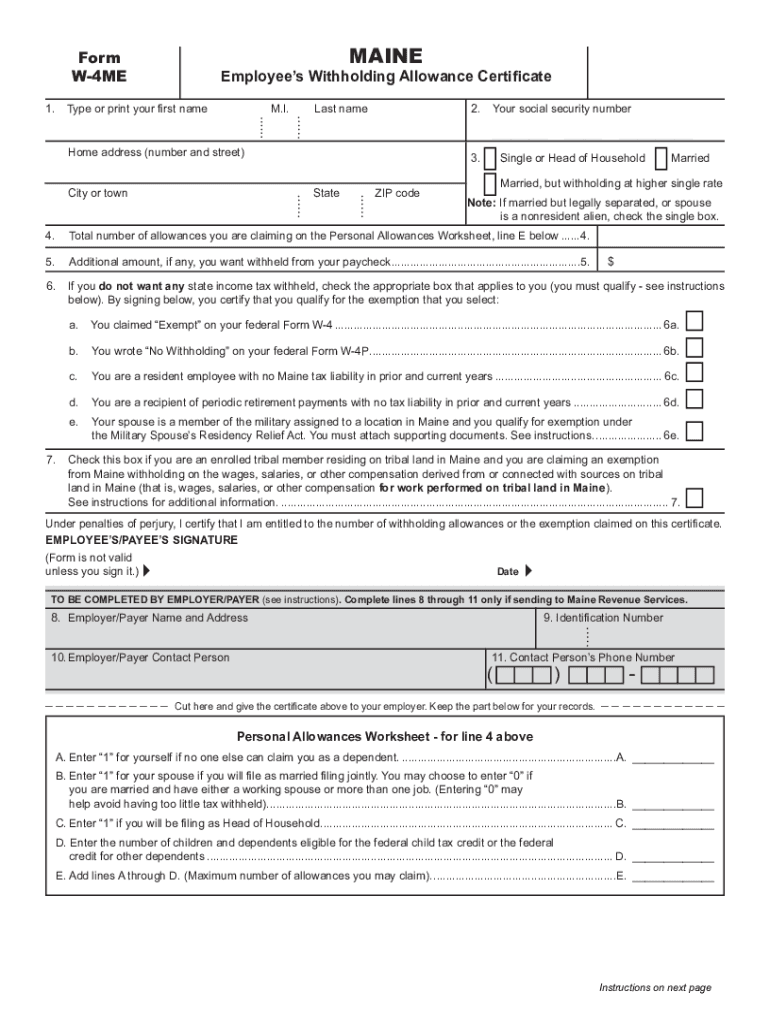

Source: w4formsprintable.com

Source: w4formsprintable.com

Il W 4 2020 2022 W4 Form, The biggest change is the removal of the allowances section. If too little is withheld, you will generally owe tax when you file your tax return.

So How Much Should You Withhold In Taxes?

Pass the irs’s “support test,”.

Number Of Withholding Allowances Claimed:

If too little is withheld, you will generally owe tax when you file your tax return.

That Should Result In The Most Accurate Withholding.

Each allowance claimed reduces the amount withheld.

Posted in 2024